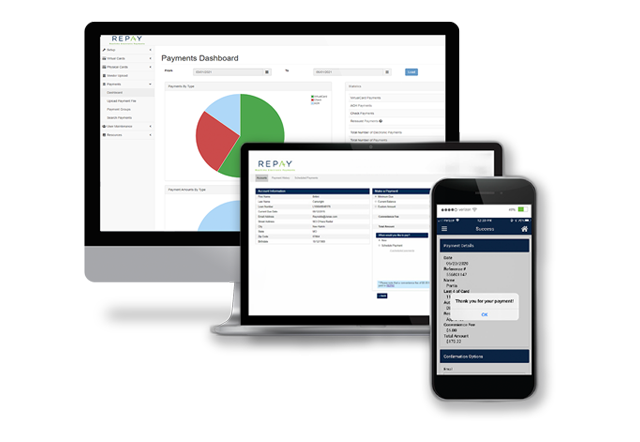

Fast, frictionless and fail-safe payment processing

Payment technology evolves quickly; you need a partner that stays ahead of the curve. REPAY combines the best, established solutions with our extensive network of integrations enabling clients to quickly accept and make payments, all from a single platform.

Powerful Solutions for Optimized Payments

-

Payment Acceptance

Offer customers flexible payment options with technology that integrates with your existing software.

-

Vendor Payment Automation

Digitize and automate payments to your vendors and suppliers, no matter their capabilities. No more checks, no more hassle.

-

Clearing and Settlement

Grow your merchant portfolio and gain more control and flexibility with our proprietary platform and customizable ISO and Payfac programs.

-

Messaging Management

Stay connected to customers through multi-channel communication tools, including digital and print and mail options.

Simplified Bill Pay for All

Present Bills and Accept Payments from Customers

Convenient and secure bill payment methods simplify the bill repayment process for your customers and enable them to pay anytime, anywhere.

Automate Bill Payments to Vendors

Gain more control and visibility and streamline workflows for your AP department through end-to-end automation and realtime payment tracking.