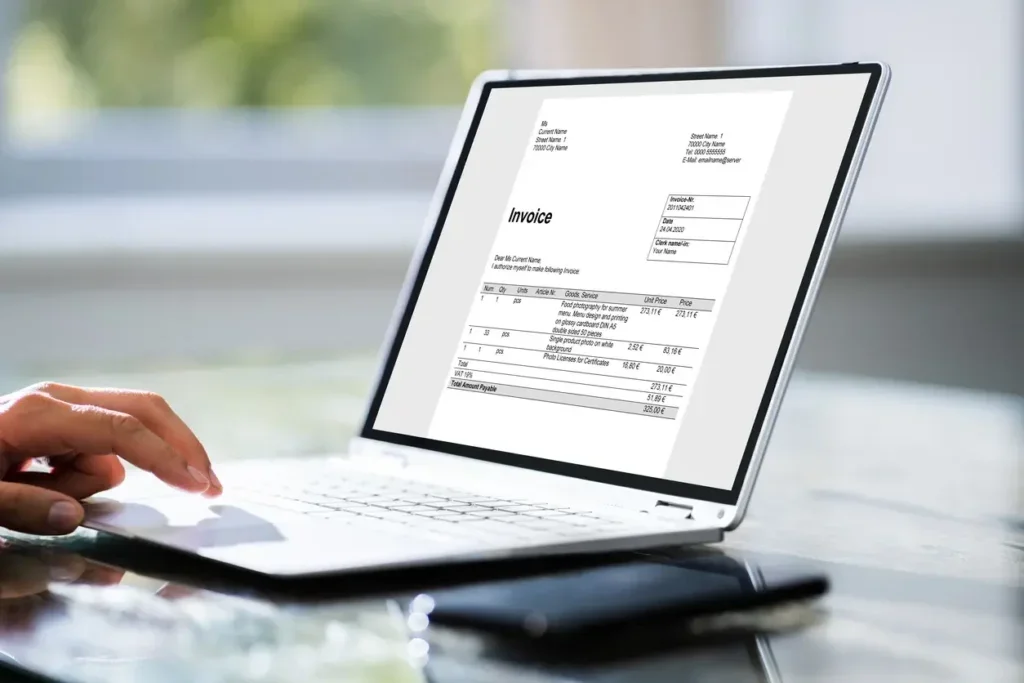

SIMPLIFY MEDIA PAYMENTS WITH SEAMLESS AUTOMATION

Manually managing supplier payments takes valuable time and resources. REPAY’s payment automation streamlines the entire process, making payments easier, faster, and more efficient. Say goodbye to paper checks and hello to increased efficiencies and rebates with our fully automated solution.

- Switch to automated, paperless payments.

- Take advantage of rebate-earning virtual cards.

- Simplify reconciliation and increase efficiency across accounts.

- Set up easily with cost-free, disruption-free ERP integration.

Explore our knowledge base

Discover quick, helpful resources to streamline your vendor payment operations. Have additional questions? Contact us at payableshelp@repay.com.

Benefits of REPAY

Traditional payment systems cost you precious time and negatively impact your bottom line. With a frictionless, centralized solution in place, you can save thousands by digitizing costly payment processes and gaining visibility and control over your funds.

Campaigns can change instantly. When suppliers require cash in hand before running a campaign, it is critical for payments to get to them quickly. Widely trusted by political advertisers, our innovative, automated electronic payments solutions enable you to reduce costs and gain efficiencies directly from your buying system.

-

End-to-end automation of political ad payments

End-to-end automation of political ad payments -

Large, established supplier network

Large, established supplier network -

Secure, flexible payment delivery

Secure, flexible payment delivery

We understand the day-to-day challenges your AP team faces, which is why we’ve developed payment automation solutions to streamline media supplier payments to enhance your AP workflow, not disrupt it. Our large supplier network of local and national broadcast station groups, entertainment destinations and other digital providers simplifies implementation.

-

Dedicated supplier enrollment team maximizes supplier participation

Dedicated supplier enrollment team maximizes supplier participation -

Digital payment options for faster delivery

Digital payment options for faster delivery -

Robust reporting offers valuable insights and payment trends

Robust reporting offers valuable insights and payment trends

Checks are slow and resource-intensive. Use enhanced ACH and virtual credit cards to expedite outbound payments while earning valuable rebates. Our established closed-loop supplier network - featuring several large media companies who accept enhanced ACH payments only through REPAY - ensures payments are received more quickly so ads can start sooner.

-

Generate significant rebates

Generate significant rebates

-

Improve timely payments and supplier relationships

Improve timely payments and supplier relationships

-

Eliminate checks and manual processes

Eliminate checks and manual processes

Your Payments. Our People.

Staffing shortages, manual processes, and security issues are causing late payments and hurting vendor relationships.

REPAY’s Payments Specialists alleviate AP pain points without having to hire additional headcount or invest in expensive technology. We make and manage every payment for you.

Meet Our PeopleSimplified Payments for successful campaigns

Alleviate the stress of election seasons and ad purchasing by automating supplier payments. Supplier payment automation integrates into leading media dashboards and accounting software, enabling media and political advertising agencies to make the best media buys more quickly. Replace checks with digital payments to save countless hours and ensure funds are delivered to the right place on time.

Digitize payments using enhanced ACH and virtual credit cards

Customize payment reminders and notifications

Reduce manual entry and paper processes

Gain control and visibility using robust reporting

Benefit from Faster, More Secure Payments

Digital payment technology evolves every day, and REPAY has the resources and expertise to keep you ahead of the changes. Rely on REPAY to simplify payments and manage the platform integrations for improved cash flow, streamlined internal processes and increased supplier and vendor satisfaction.

REPAY pays more media vendors electronically than any other payment provider. Just ask these satisfied clients.

STAY UP TO DATE

Subscribe to our blog mailing list and be the first to know about the latest resources, industry insights and news from REPAY.

LEARN MORE ON THE BLOG

Reason Checks Are Not Cutting it for Businesses

For many businesses, 2022 was a year of digital transformation. Continuing through 2023, we expect more companies to leave behind the days of paper and manual processes and take that first step to digitize processes by automating their payment procedures and ditching paper checks.

AP Automation Isn't Just for Large Businesses: SMBS Can Flourish Too

Small to medium businesses (SMB) across the U.S. are still feeling the ripple effects of the pandemic with supply chain issues, rising interest rates, growing inflation and uncertain economic conditions. As we approach 2023, inflation is the primary concern.

How AP Automation Creates a Better Payment Experience for Businesses and Vendors Alike

It might (or might not) surprise you that many B2B businesses are still using outdated payment methods like paper checks for their accounts payable (AP) processes. In fact, according to a study from PYMNTS, “25% of B2B payments are made via paper checks.”